So why a book a week challenge?

So why a book a week challenge? They say that leaders are readers. The average successful CEO reads a book a week. Yes that is

So why a book a week challenge? They say that leaders are readers. The average successful CEO reads a book a week. Yes that is

Are you on the lookout for a cozy and inviting new home in Cleveland, Ohio? Well, you’re in luck! We’re thrilled to introduce our latest

Are you ready to elevate your living experience? We have an exciting new listing that’s bound to capture your heart! Nestled in the heart of

Excitement is in the air as we unveil a new listing that could be the home you’ve been searching for! Nestled in the heart of

Embark on a journey to find your perfect home sweet home with our latest listing in the heart of South Euclid. Welcome to 4070 Wyncote

Looking for a place that combines style, convenience, and affordability? Your search ends here! We’re thrilled to unveil a fantastic new listing that could be

Copyright © 2021 Realty Trust Services - All Rights Reserved. We may send out a monthly newsletter if you contact us through our web form. Andrew W. Morris is a licensed real estate broker with the State of Ohio (BRK.2008004009). Realty Trust Services, LLC is registered with the State of Ohio as a real estate company (REC.2009001863). This page was last updated.

Follow this link and click “Record Video” button to record a quick video testimonial using your webcam and computer microphone.

Note: This website is not affiliated with or endorsed by Yelp.

Facebook lets us stay connected with our customers, fans and friends—and now lets you review businesses.

From our Facebook page:

Note: This website is not affiliated with or endorsed by Facebook.

YP is “dedicated to helping local businesses and communities grow.” They collect ratings and reviews of local businesses and service providers.

You can use your Facebook account to post a review. From our listing:

Click “Write a review” in the talkbox below our listing

Write as much as you’d like and give us a star rating

Note: This website is not affiliated with or endorsed by YP.

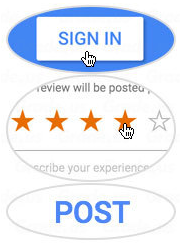

If you don’t already have a Google account, you should—use it to read and post reviews, as well as access other Google products like Gmail.

From our Google listing:

If prompted, sign up or log in

Leave your rating and feedback

Note: This website is not affiliated with or endorsed by Google.

Thank you! We need your help. Would you share your experience on one of these sites?